Boulder could face $10M budget shortfall due to COVID

Saturday, April 4, 2020

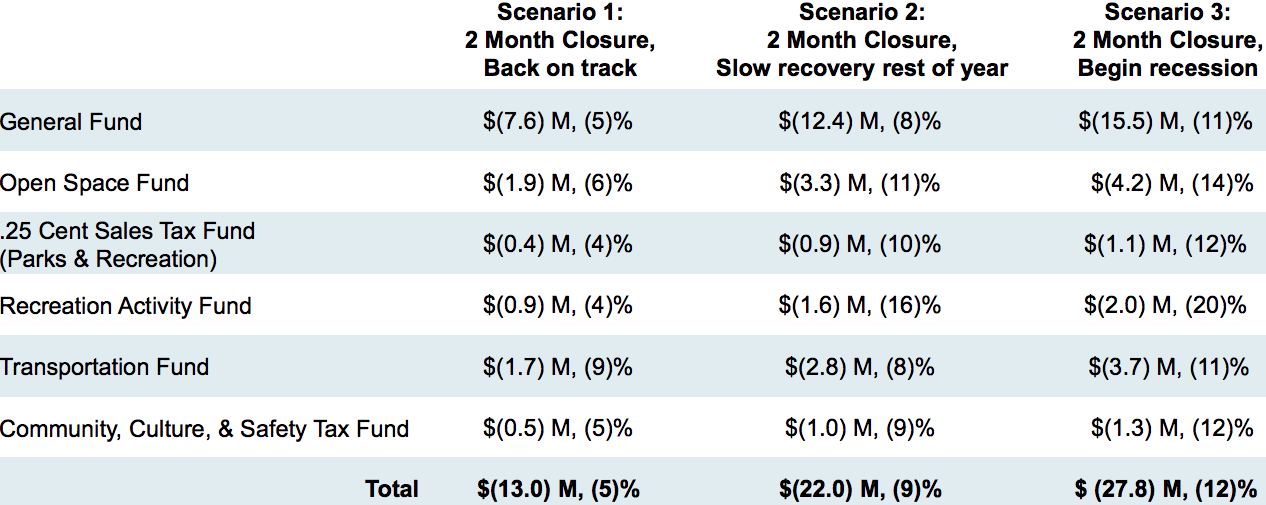

COVID-19 could exact a heavy toll on Boulder’s already somewhat constrained budget, according to projections laid out by the city’s financial experts this week. Early modeling predicts a more than $27 million reduction in the city’s major revenue sources that, even when shored up with emergency and excess cash, may leave a $10 million gap in the operating budget.

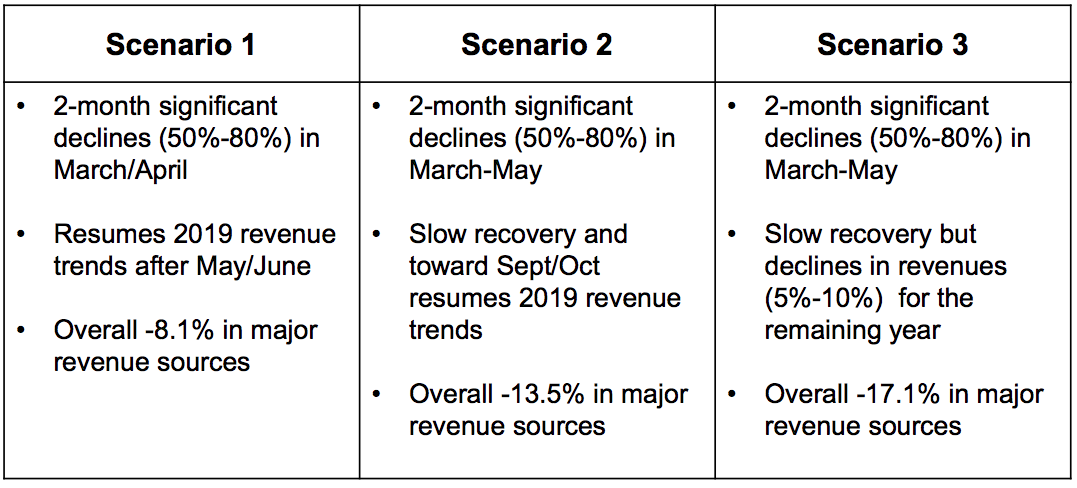

Boulder’s chief budget and financial officers, Kady Doelling and Cheryl Pattelli, laid out three scenarios for city council on Tuesday. All assumed a 50-80% slowdown in sales and use tax collection from March to May.

While the first two predictions assumed a return to 2019 revenue projections this year, the last — and, in their opinion, most likely — is one in which 2020 consumer spending declines 5-10% overall. That would lead to a 17% decrease in revenue sources that fund the majority of Boulder’s budget.

“We actually think (this) is a likely scenario,” CFO Patella said.

And, Doelling added, “this may not be the worst scenario.” She and Pattelli chose it as a “starting point” to illustrate the impact of significant declines.

What is now being pitched as worst-case, Doelling said, “may eventually be ideal.”

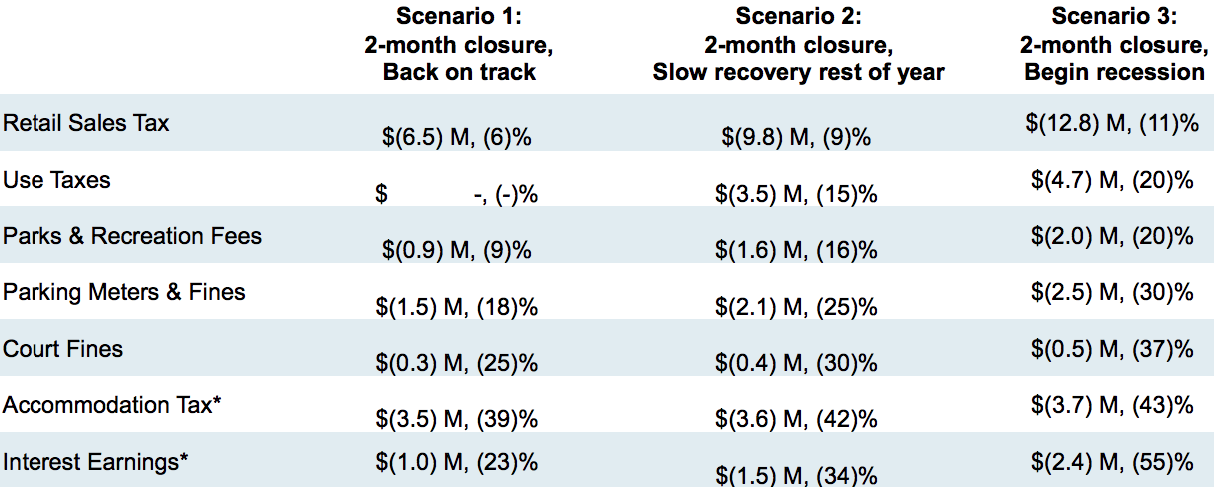

Boulder is missing out not only on retail sales tax due to widespread business closures, but is also foregoing funding from things like parking meters and garages, as well as fees for now-shuttered rec centers and cancelled programs. Roughly 70% of the city budget is likely to be impacted by COVID, according to Doelling and Pattelli.

The models do account for increase in spending on some things, including groceries. Major retailers Walmart, Costco and Target all recently reported lower traffic than at this time last year despite initial spikes in February and March.

Many of the predictions are based on what happened in China, as well as national models. There are notable differences: Namely, that the U.S. economy relies more heavily on retail than does China’s. That’s doubly true in Boulder, Doelling said.

“Boulder’s primary businesses are small retail shops, restaurants and bars,” she said, “all of which have been forced to close or partially close. We don’t have a community with big box stores that may be seeing an increase” in sales.

And though the city tends to have lower unemployment than Colorado and the U.S., there are other factors working against a quick local recovery — like the 30,000 University of Colorado students who typically stay (and spend) through May, and the 64,900 in-commuters who are now mostly working from home or not working at all.

“Although Boulder was largely spared from the economic impacts of the Great Recession,” Doelling said, “we predict the current situation will be significantly different.”

Retail sales tax could decline by $12.8 million under the likely scenario, an 11% decrease from current trends. That would correspond to an 11% dip in general fund revenue, leaving $15.5 million fewer discretionary dollars to pay for police, fire, the library and other essential functions.

Dedicated sources will be hard-hit as well, Doelling said — especially the already depleted transportation fund: “Transportation is going to be hit significantly more because not only are they heavily reliant on sales and use tax, but they also have the highway users tax, or the gas tax, which is being significantly impacted.”

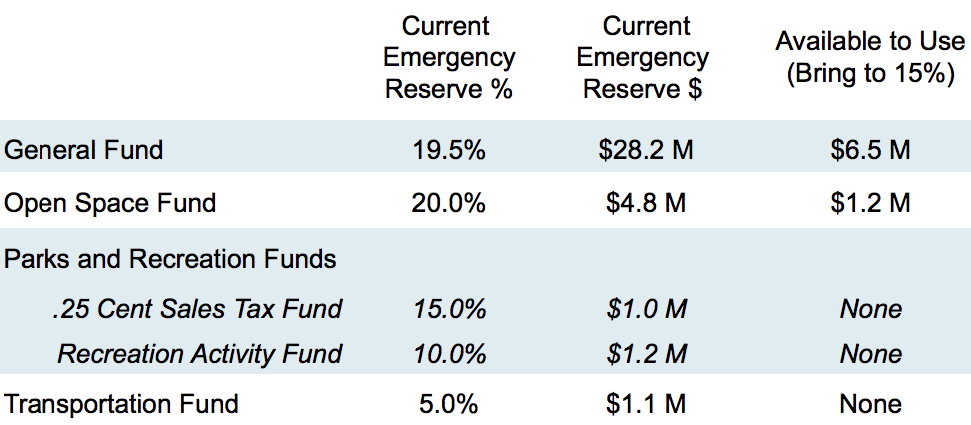

The city does have emergency stockpiles, having stowed away cash for the past several years in pursuit of the golden standard: 20% of each particular fund held in reserve. Yet only one fund — open space — has reached that threshold. The general fund was on its way to 20% this year, but council pulled out money earmarked for reserves and put it instead toward the under-construction North Boulder library branch.

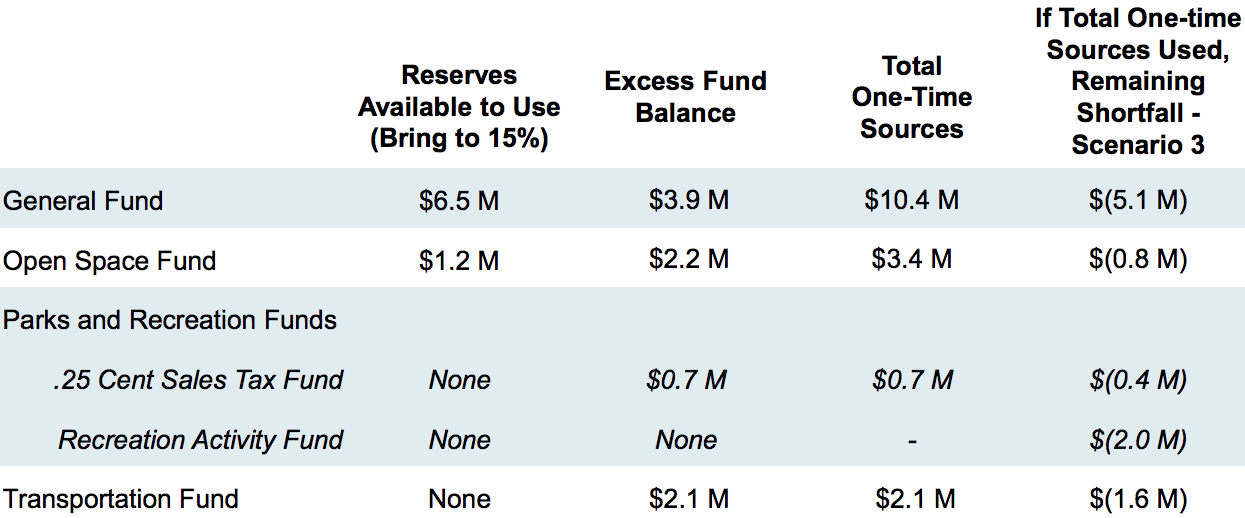

There is still considerable cash available. Best practice recommends, at minimum, 15% reserves, freeing up $6.5 million for emergency spending in the general fund and $1.2 million for open space purposes.

In 2019, the city brought in more money than anticipated, leaving $7.7 million in excess funds that can also be applied to the shortfall. Even when combined with reserves, that won’t be enough to fill the gap entirely.

Boulder will still come up $9.9 million short between its four biggest funds. More than half of the overall deficit ($5.1 million) will be in the all-important general fund.

Boulder may be able to recoup some of its losses. Under the recently passed CARES Act, Colorado is set to get $2.2 billion from the feds, but up to $1 billion of that can be claimed by its four largest counties (Denver, El Paso, Arapahoe and Douglas), and the remaining $1.2 billion will not necessarily be shared.

“The state is the one that’s going to decide whether or not they keep all the money or share it,” City Manager Jane Brautigam said Tuesday. “No other county and no other city is guaranteed to get anything (and) the state has been silent” so far.

Because Boulder declared a state of emergency, it is entitled to have some of its COVID-related costs covered. It’s unclear how much money will be available or what it can be used for.

“We don’t know if our giving grants or rental payments would be considered COVID-related expenses, or if it’s going to be things instead like setting up the COVID recovery center” for unhoused individuals, Brautigam said. As such, “I want to caution the council on making early decisions before we know if we’re going to get money and what we’re going to get backfilled for.”

Boulder County is set to receive $485,056 in Community Development Block Grants under the stimulus package, the Daily Camera reported Thursday. Some of that will flow to the city, Director of Housing and Human Services Kurt Firnhaber wrote in response to emailed questions, but it’s still unknown how much. That information may be available for the April 7 council meeting.

More details on the extent of Boulder’s recent sales tax decline won’t be revealed until April 28, when revenue receipts for March are ready. A study sessionA council meeting where members deep-dive into topics of community interest and city staff present r... on the budget was already planned, to take a look at Boulder’s long-term financial situation. Now the meeting will likely focus heavily on COVID impacts.

“At this time, without knowing much about January, February and March sales tax remittance, it’s kind of a shoot-in-the-dark” conversation, Doelling said. However, “we will need to be taking actions, and the sooner we do it, the better.”

Read a play-by-play of Tuesday’s discussion here. Note: This thread also includes a COVID update from county health and hospital officials.

The city is already looking at ways to cut expenses. A hiring hold has been implemented, the first since spring 2018 when Boulder was facing a $4 million shortfall due to sluggish retail sales. That slowdown was short-lived, as 2019 revenue beat projections.

These impacts are likely to be felt beyond 2020. Property tax collection may decline as home values dip, Doelling warned. Already the city is asking departments to identify capital and operating projects that can be delayed.

The COVID crisis will put a finer point on discussions council was already beginning to have about Boulder’s long-term budget outlook. Multiple departments have reported millions of dollars in backlogged maintenance and other unfunded needs. Sales tax was projected to continue its slowdown even before the pandemic, due to an aging population.

Council has in the past taken a do-it-all approach to the city’s finances, reversing planned cuts and adding in additional dollars during the budget process. Several taxes and fees were being proposed for November’s ballot to shore up spending on affordable housing, transportation and climate initiatives, officials perhaps relying on a populace that rarely turns down increases or extensions.

That may not be the case moving forward, councilman Aaron Brockett noted.

“It’s really going to be a judgement call based on what services we might be losing or what additional support we want to offer to community members in need,” Brockett said. “Those will be the tradeoffs we’ll have to make. It will be very much not an abstract conversation about numbers and very much a concrete conversation about what are we losing or what could we gain.”

— Shay Castle, boulderbeatnews@gmail.com, @shayshinecastle

Want more stories like this, delivered straight to your inbox? Click here to sign up for a weekly newsletter from Boulder Beat.

Budget COVID-19 Aaron Brockett Arapahoe County Boulder Boulder County budget CARES Act city council city of Boulder Community Development Block Grant Costco COVID COVID-19 CU Daily Camera Denver Douglas County El Paso County general fund Great Recession housing human services Jane Brautigam library long-term financial planning North Boulder open space pandemic property tax sales tax Target tax increase taxes transportation University of Colorado Walmart

5 Comments Leave a comment ›