Ballot issues 2A, 2B: Climate Tax + Bonds

Read all Boulder Beat’s Election 2022 coverage — y en español

Monday, Oct. 10, 2022

Ballot Issue 2A – Climate Tax (TABOR)

and

Ballot Issue 2B – Approving Issuance of Bonds to be Paid from Climate Tax (TABOR)

Ballot language

SHALL CITY OF BOULDER TAXES BE INCREASED $6.5 MILLION (FIRST, FULL FISCAL YEAR DOLLAR INCREASE) ANNUALLY AND INCREASING ANNUALLY BY THE CONSUMER PRICE INDEX BY IMPOSING A CLIMATE TAX ON THE DELIVERY OF ELECTRICITY AND NATURAL GAS AS PROVIDED IN ORDINANCEA piece of municipal (city-level) legislation. 8542; AND SHALL THE EXISTING CLIMATE ACTION PLAN EXCISE TAX SET TO EXPIRE MARCH 31, 2023 AND THE UTILITY OCCUPATION TAX SET TO EXPIRE DECEMBER 31, 2025 BE REPEALED; AND SHALL THE CLIMATE TAX BEGIN JANUARY 1, 2023, AND EXPIRE DECEMBER 31, 2040; WITH THE REVENUE FROM THE CLIMATE TAX AND ALL EARNINGS THEREON TO BE USED TO MAINTAIN AND EXPAND CLIMATE FOCUSED PROGRAMS AND SERVICES, FINANCE CERTAIN CAPITAL PROJECTS AND STABILIZE FUNDING FOR INITIATIVES TO MEET THE CITY’S CLIMATE GOALS; INCLUDING WITHOUT LIMITATION ITEMS SUCH AS RESIDENTIAL AND BUSINESS INCENTIVES TO REDUCE ENERGY USE; ACCELERATE BUILDING WEATHERIZATION AND ELECTRIFICATION; LOCAL RENEWABLE ENERGY GENERATION AND STORAGE; MICROGRIDS AND DISTRICT SYSTEMS THAT LEAD TO INCREASED SYSTEM RELIABILITY AND RESILIENCE; EQUITABLE INVESTMENTS IN HIGH PERFORMING, HEALTHY BUILDINGS; SERVICES TO SUPPORT ZERO EMISSION; MOBILITY OPTIONS WITH AN EMPHASIS ON SOLUTIONS FOR CURRENTLY UNDERSERVED SEGMENTS OF THE COMMUNITY; ZERO-WASTE EFFORTS INCLUDING REUSE, REPAIR AND RECYCLING; NATURAL CLIMATE SOLUTIONS TO ENHANCE ECOSYSTEMS, IMPROVE AIR QUALITY AND BUFFER EXTREME HEAT EVENTS; GRANTS FOR COMMUNITY-BASED CLIMATE AND RESILIENCE ACTIONS; WILDFIRE RESILIENCE STRATEGIES SUCH AS WILDFIRE HOME RISK ASSESSMENTS, WILDFIRE MITIGATION PLANNING AND IMPLEMENTATION; OUTREACH AND EDUCATION; RESIDENTIAL AND BUSINESS GRANTS/REBATES FOR THE ACCELERATION OF UNDERGROUNDINGBurying power lines underground. This reduces outages, which are often caused by trees, etc. falling... UTILITY LINES IN HIGH-RISK AREAS; GRANTS/REBATES FOR QUALIFYING FINANCIAL ASSISTANCE FOR LOW-INCOME UTILITY CUSTOMERS; LEVERAGE FOR OTHER FUNDING SOURCES SUCH AS FEDERAL INFRASTRUCTURE, CLIMATE, AND RESILIENCE FUNDS TO MEET LOCAL NEEDS; AND COST-SHARING AGREEMENTS FOR EMISSIONSIn this context, the GHG that are released into the atmosphere from the burning of fossil fuels to g... MITIGATION AND CLIMATE RESILIENCE?

and

SHALL CITY OF BOULDER DEBT BE INCREASED UP TO $52.9 MILLION (PRINCIPAL AMOUNT) WITH A MAXIMUM REPAYMENT COST NOT TO EXCEED $75 MILLION (SUCH AMOUNT BEING THE TOTAL PRINCIPAL AND INTEREST THAT COULD BE PAYABLE OVER THE MAXIMUM LIFE OF THE DEBT) SUCH DEBT TO BE ISSUED ONLY IF THE VOTERS APPROVE THE CLIMATE TAX IN BALLOT ISSUE 2A AND PAYABLE FROM THE CLIMATE TAX AND FROM OTHER LEGALLY AVAILABLE REVENUES AS DETERMINED BY COUNCIL; WITH THE PROCEEDS OF SUCH DEBT AND EARNINGS THEREON BEING USED FOR THE SAME PURPOSES AS THE CLIMATE TAX IN THE BALLOT ISSUE?

What it means

Should Boulder replace two existing taxes that fund climate work — the CAP and UOTUtility Occupation Tax. The first part was initially passed in 2010 by voters, to replace the Xcel f... (more on those later) — with one general climate tax to be paid through 2040 and also increase the tax by about $2.6 million per year (compared to the current taxes) in the first year? The tax will increase with inflation every year thereafter until 2040, when it expires.

and

Should Boulder use the future tax revenue to borrow up to $52.9 million? With the costs of repayment, the total debt will be $75 million.

What two taxes are being replaced?

The CAP (Climate Action Plan) Tax and the UOT (Utility Occupation Tax), which together bring in $3.9 million per year. More information about the CAP and UOT can be found at the end of this article.

According to city staff, the repurposed UOT and CAP were overlapping, one reason staff wanted to replace them both with a single climate tax.

“We started to see a lot of duplication of the types of things those dollars were paying for,” Director of Climate Initiatives Jonathan Koehn said in an August interview.

Both taxes also helped fund Boulder’s participation in a lobbying group, Colorado Communities for Climate Action. The coalition of local governments helped push for — and pass — 42 pieces of legislation in 2021 alone that furthered the state’s climate goals.

How much will taxes go up?

That depends on who you are. This is a tax on energy consumption — electricity and natural gas — and the city is restructuring the rates so that businesses pay more and homeowners pay less (more on that later).

Because it’s based on how much energy you use, there isn’t a hard-and-fast rule about how much your energy bill will increase. The city did calculate some average expected rates:

Residential: $49.66 per year (an additional $6.71 per year, or 15.6%, over current CAP + UOT)

Commercial: $487.37 (an additional $194.95 or 66.7%)

Industrial: $1,806.85 (an additional $722.74 or 66.7%)

What will we get for it?

Much of what we’re already getting, plus $1.5 million for preventing and responding to wildfires. It will pay for such things as:

- A dedicated fire risk-assessment team

- Grants to support residential wildfire risk-prevention measures like vegetation management, fence reconstruction and roofing/siding replacement

- Strategic undergrounding (burying) of power lines

- Ecosystem restoration

- Tree thinning in targeted, strategic areas

- Prescribed, targeted cattle grazing that may help reduce the risk of catastrophic fire while also delivering ecosystem health benefits

- Weed management and invasive species removal

- Prescribed burning to reduce fine fuels

- Supplementing debris- and vegetation-removal work along irrigation ditches; and

- Updating and implementing a revised community wildfire protection plan for open space properties.

City climate staff said future climate work may focus more on resilience and equity, and new priorities may be added to the recently updated Climate Action Plan. That means dealing with the fallout from climate change, which is already happening and more likely to impact low-income and other vulnerable populations disproportionately.

Such spending could include low-income solar gardens or weatherization of mobile home communities, according to climate spokesperson Emily Sandoval. Future efforts could focus on mitigation of flooding and other extreme weather events, including cooling centers for vulnerable residents in extreme heat or planting trees and/or other plants to reduce the urban heat island effect.

“There’s tremendous flexibility” in the tax, Koehn said in August. “We have a number of mature and core programs we want to maintain and accelerate and build on.”

See more discussion of spending vs. outcomes below.

Who is supporting and opposing?

There are no formal groups advocating for or against this tax, which was brought forward by the city itself.

Why you might want to vote for this

There is an urgent need for climate action. (We’re assuming you agree with this; otherwise, you wouldn’t need to read this article to decide how you’re voting.)

This is mostly a replacement and extension of existing taxes (though there is an increase, particularly for businesses. See more below under reasons to not vote for this tax).

This would help continue existing programs and provide much-needed money for wildfire mitigation and response, another critical and urgent need. Future revenue could go toward floods and/or other water issues, according to city staff. All of these areas are impacted by climate change.

It’s more equitable in the sense that the biggest consumers of energy (and contributors to greenhouse gas emissions) are paying more. Per city staff, under the existing taxes, “Boulder’s businesses are responsible for 80% of energy-related emissions but historically have paid 36% of CAP Tax revenues.”

The ability to borrow money against the tax will allow for immediate big spending — particularly important to pursuing systemic change. Projects the city is considering (building microgrids and storage, buying energy-efficient buses or installing electric vehicle charging stations, for instance) will require lots of money upfront.

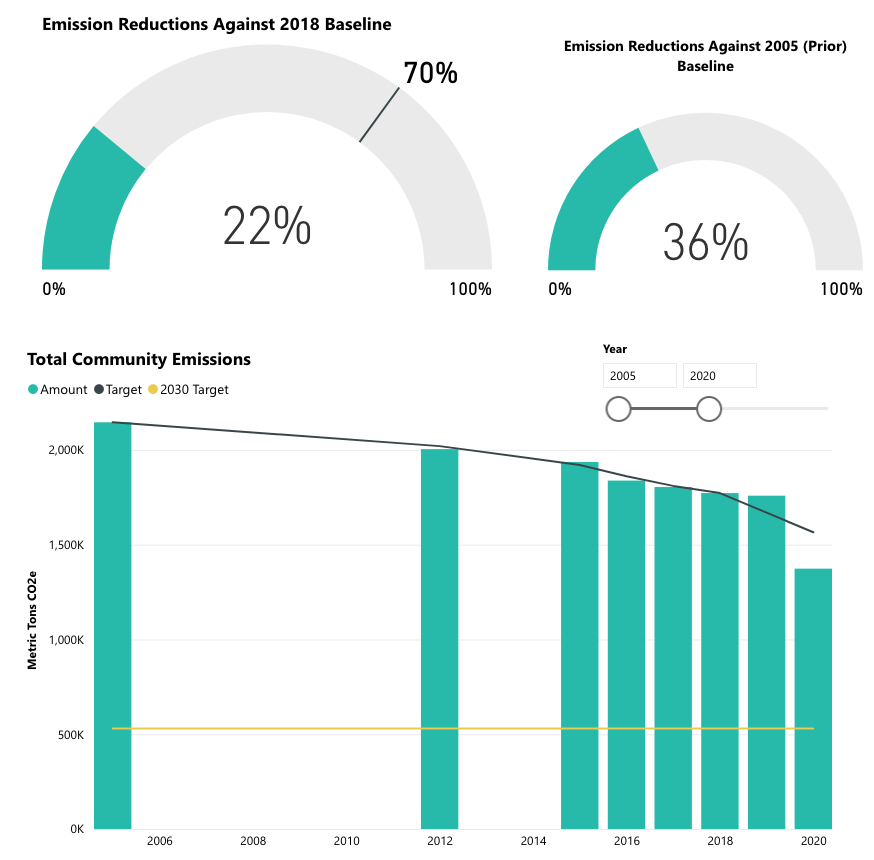

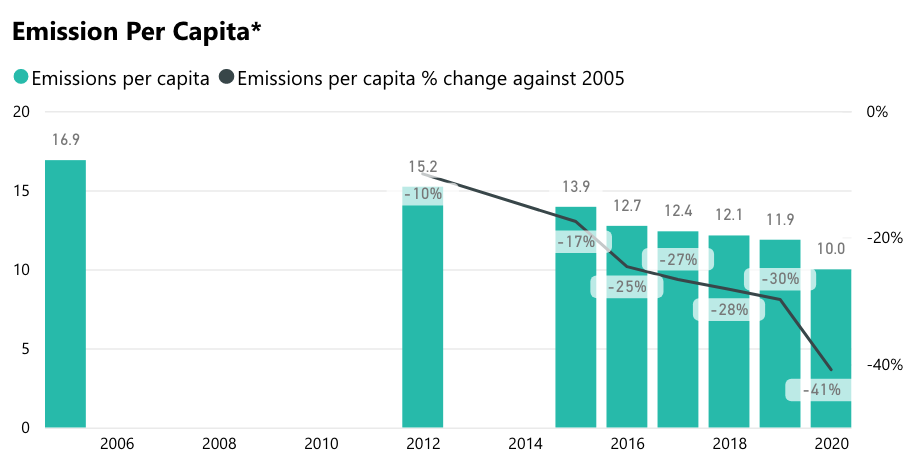

The city has measurably reduced its emissions even as the economy has grown. While much of Boulder’s past efforts focused on municipalization (more on that later), overall emissions have decreased 22% since 2018 and 1.3% per year since 2005. (A longer comparison is needed because the pandemic contributed greatly to a 33% decrease in transportation emissions, along with other reductions related to the economic slowdown.)

“Despite growth in Boulder’s population, gross domestic product (GDP), and square footage since 2005 (by 10%, 87%, and 12% respectively),” the city’s 2020 greenhouse gas inventory notes, “Boulder continues to reduce its emissions year over year.”

Total emissions per gross domestic product — metric tons per dollar — have decreased 35% since 2018 and 66% since 2005.

Why you might not want to vote for this

Why you might not want to vote for this

Although this is replacing two existing taxes, it is still a tax increase, one of several on this year’s ballot.

The increase is particularly pronounced for businesses, the overwhelming majority (97%) of which are small, with fewer than 50 employees.

The city argues that businesses have received a lot of value from existing climate taxes. In 2021 alone, businesses paid $600,000 in CAP taxes but saved over $2 million in energy costs from city-funded building upgrades. (Worth noting: The Boulder Chamber is remaining neutral on 2A and 2B, rather than opposing them.)

City funding is not the only source of money for climate change (or wildfires, for that matter). This year’s ballot includes two county tax increases that will funnel money into preventing and fighting fires. The Federal Inflation Reduction Act included $370 billion to fight climate change — the largest single investment for such purposes in U.S. history. Colorado, too, has its own goals and budget for various emissions-reduction efforts.

Here, city staff argue that having local money and/or staff helps get those federal and state dollars. Free federal money isn’t free; it takes time and effort to apply for grants.

“Our ability to preserve staff (is) going to help draw more of those dollars in,” said Carolyn Elam, senior sustainability manager.

There are also some who argue that the city has not been a good steward of money in the past when it comes to climate change, citing the 10-year and $30 million-plus effort to take on XcelXcel Energy, a publicly traded utility company based in Minnesota. that ended in a settlement in 2020. More recent criticisms have focused on setbacks in the zero-waste initiative, with high contamination forcing a rule change and drop in the amount of business composting.

The city maintains that the muniA utility that would be owned by the city of Boulder. Shorthand for municipalization, which is the p... effort was necessary to push Xcel toward more climate-friendly practices. And Boulder’s waste diversion has “been among the most successful in the state,” Sandoval said — the city sent 47% of its waste to landfills in 2021, versus 83% in 2005.

Composting setbacks demonstrate the importance of a multi-pronged approach to climate change, one that includes lobbying efforts.

“Our community will be more successful, and have a bigger impact, if we can reduce the amount of single-use materials used in the first place,” Sandoval wrote in response to emailed questions. “That’s why Boulder was so active in advocating for the passage of the Plastic Pollution Reduction Act last year.”

Relatedly, critics have pointed out that there is no cost-benefit analysis of this spending and no calculation of the cost per ton to reduce carbon based on what Boulder is already spending. That makes it hard to measure the efficacy of city efforts or to compare how we’re doing relative to other cities, states or countries.

Again, city staff stress the importance of having people on payroll.

“If you’re helping a senator draft a bill that was ultimately successful, and CAP paid for staff time,” that might result in real emissions reductions that aren’t captured in city data, Elam said.

Furthermore, emissions reduction is not the only measure of successful climate initiatives, Elam and Koehn said, referencing city priorities for resilience and equity.

Helping low-income households reduce their energy costs as temperatures rise, making open space more likely to withstand a fire, protecting neighborhoods from flooding — these things aren’t directly related to emissions reduction, but they are related to climate change and the city’s approach to it.

“Metric tons of carbon is not the only thing you should be thinking about,” Koehn said.

Want more? Read opposing opinions on 2A and 2B:

Yes on 2A, 2B: Governments (and Boulder) need to lead on climate change

No on 2A, 2B: Climate tax funds employee paychecks, not carbon reduction

What are the CAP and UOT, and what did they pay for?

CAP was first approved in 2006, a surcharge on electricity consumption. It was meant to help the city achieve emissions reductions related to the Kyoto Protocol and was therefore set to expire in 2012. But it was extended twice, to 2015 and then again to March 2023.

Over its lifetime, the CAP Tax has raised $22 million and funded things like:

- Direct cash assistance to homeowners, landlords and businesses to fund energy-efficiency upgrades

- Development of a solar-powered backup energy system for Boulder Housing Partners

- Construction of a solar garden for the Ponderosa Mobile Home Community

- Electrification of city HOP buses

- Installation of city-owned electric vehicle charging stations

- Greenhouse gas inventories, solar potential studies and EV strategies

Learn more about what the CAP funded

The UOT began as a way to replace money in Boulder’s general fund generated by being under a franchiseA legal agreement between a power provider and customer (in this case, Xcel and Boulder) governing t... with Xcel Energy. That money stopped coming in when the city attempted to separate from Xcel. Like the CAP, it was also extended twice, including in 2020 when Boulder went back under franchise.

UOT funds were repurposed toward projects pursued in partnership with Xcel, things like:

- Utility bill assistance for low-income residents

- Electrification of buildings and transportation

- Streetlight acquisition

- Improvements for mobile homes damaged in the December 2021 wind storm

More information

bouldercolorado.gov/climate-tax-frequently-asked-questions

Climate Elections 2A 2B Boulder CAP city of Boulder Climate Action Plan climate tax elections emissions renewable energy taxes UOT Utility Occupation Tax

Do note that most of the carbon reduction that Boulder claims credit for is actually based on the renewables that Xcel has added to their system. Boulder really shouldn’t get credit for that and should subtract that to show the actual net benefit that Boulder alone has created.